utah restaurant food tax rate

We would like to show you a description here. Certain purchases including.

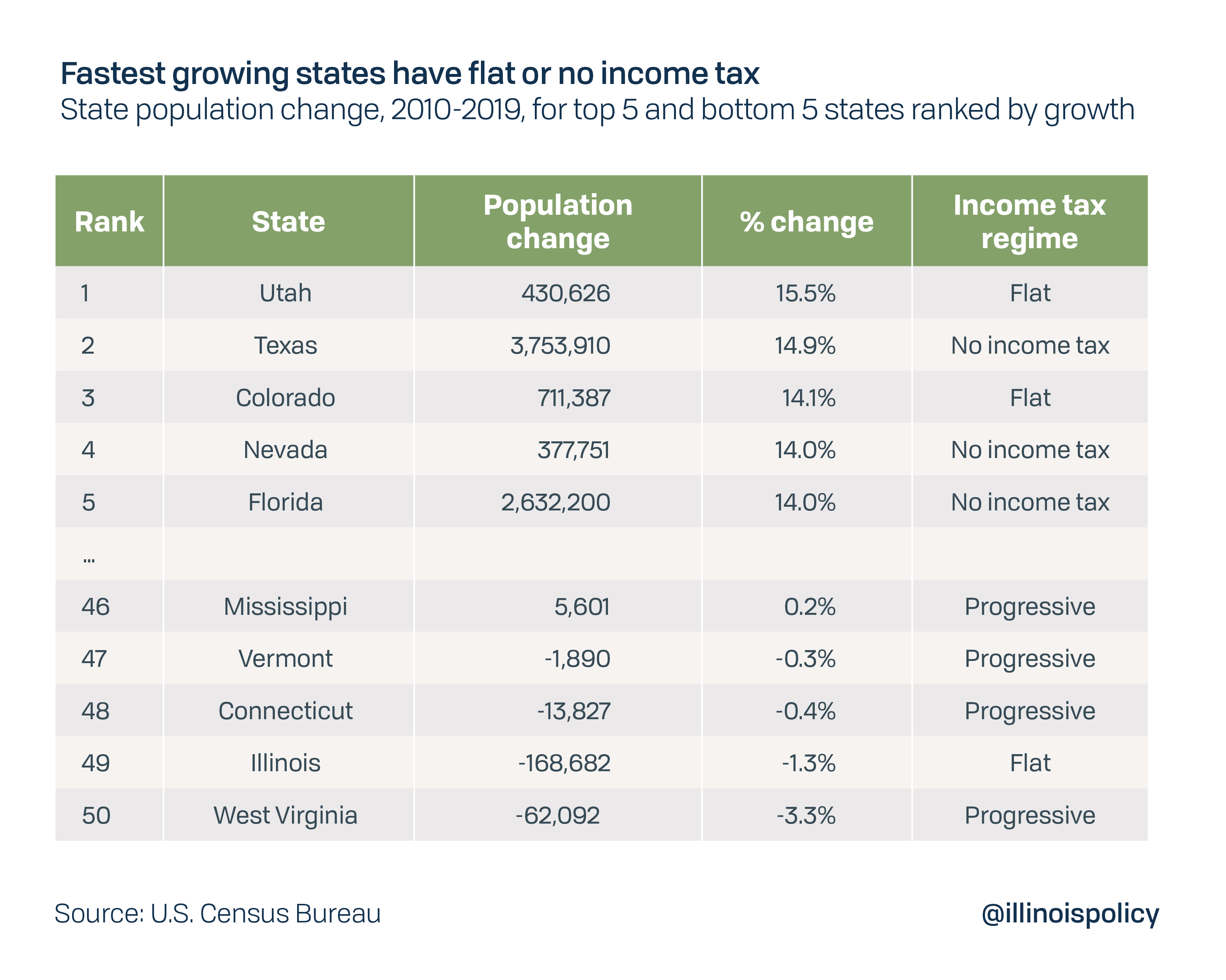

Every State With A Progressive Tax Also Taxes Retirement Income

2022 Utah Restaurant Award Nominations We are now accepting nomination applications for our Utah Restaurant awards.

. Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005. Deli Inside a Store. In resort communities the Resort Exempt rate is the Combined Sales and Use tax rate minus the resort community tax.

In the state of Utah the foods are subject to local taxes. Utah has state sales. The award winners will be announced at the Utah Restaurant.

93 rows This page lists the various sales use tax rates effective throughout Utah. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys.

In the state of Utah the foods are subject to local taxes. However in a bundled transaction which. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Chicago Restaurant Tax. The Utah sales tax rate is 595 as of 2022 with some cities and counties adding a local sales tax on top of the UT state sales tax. Utahs sales tax rates for commonly exempted categories are.

The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax. Average Sales Tax With Local. As of this writing groceries are taxed statewide in Utah at a reduced rate of 3.

271 rows 2022 List of Utah Local Sales Tax Rates. Items like alcohol and prepared food including restaurant meals and some premade. Both food and food ingredients will be taxed at a reduced rate of 175.

Exemptions to the Utah sales tax will vary by state. Food versus Non-Food Matrix. The restaurant tax applies to all food sales both prepared food and grocery food.

Groceries is subject to special sales tax rates under Utah law. Both food and food ingredients will be taxed at a reduced rate of 175. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state.

However in a bundled transaction which involves both food. 2022 Sales Tax Rates State Local Sales Tax By. 91 rows This page lists the various sales use tax rates.

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer.

Form Tc 62f Fillable Utah Restaurant Tax Return

Washington Sales Tax For Restaurants Sales Tax Helper

Restaurant Costs In Utah How Much Should Owners Spend Usa Projects

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Ms Cheap Tennessee S Tax Holiday 2022 Offers Savings On Groceries For All Of August Ms Cheap Mainstreet Nashville Com

Restaurant Wine Markups The Reluctant Gourmet

Form Tc 62f Fillable Utah Restaurant Tax Return

Grocery Prices Inflation And Food Taxes Don T Mess With Taxes

Sales Taxes In The United States Wikiwand

Food Tax Repeal Think New Mexico

States Without Sales Tax Article

Utah Sales Tax Rate Rates Calculator Avalara

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

Sales Tax By State To Go Restaurant Orders Taxjar

Everything You Need To Know About Restaurant Taxes

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Everything You Need To Know About Restaurant Taxes Eagleowl Restaurant Management And Analytics Software

General Sales Taxes And Gross Receipts Taxes Urban Institute